unrealized capital gains tax california

California long term capital gain rate 133. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US.

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

Total long term capital gain rate 567.

. What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. National Investment Income Tax 38.

Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital. The so-called Equitable Recovery for California Businesses and Jobs plan includes 575 million for small business grants 7775 million in tax credits to businesses that. Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm.

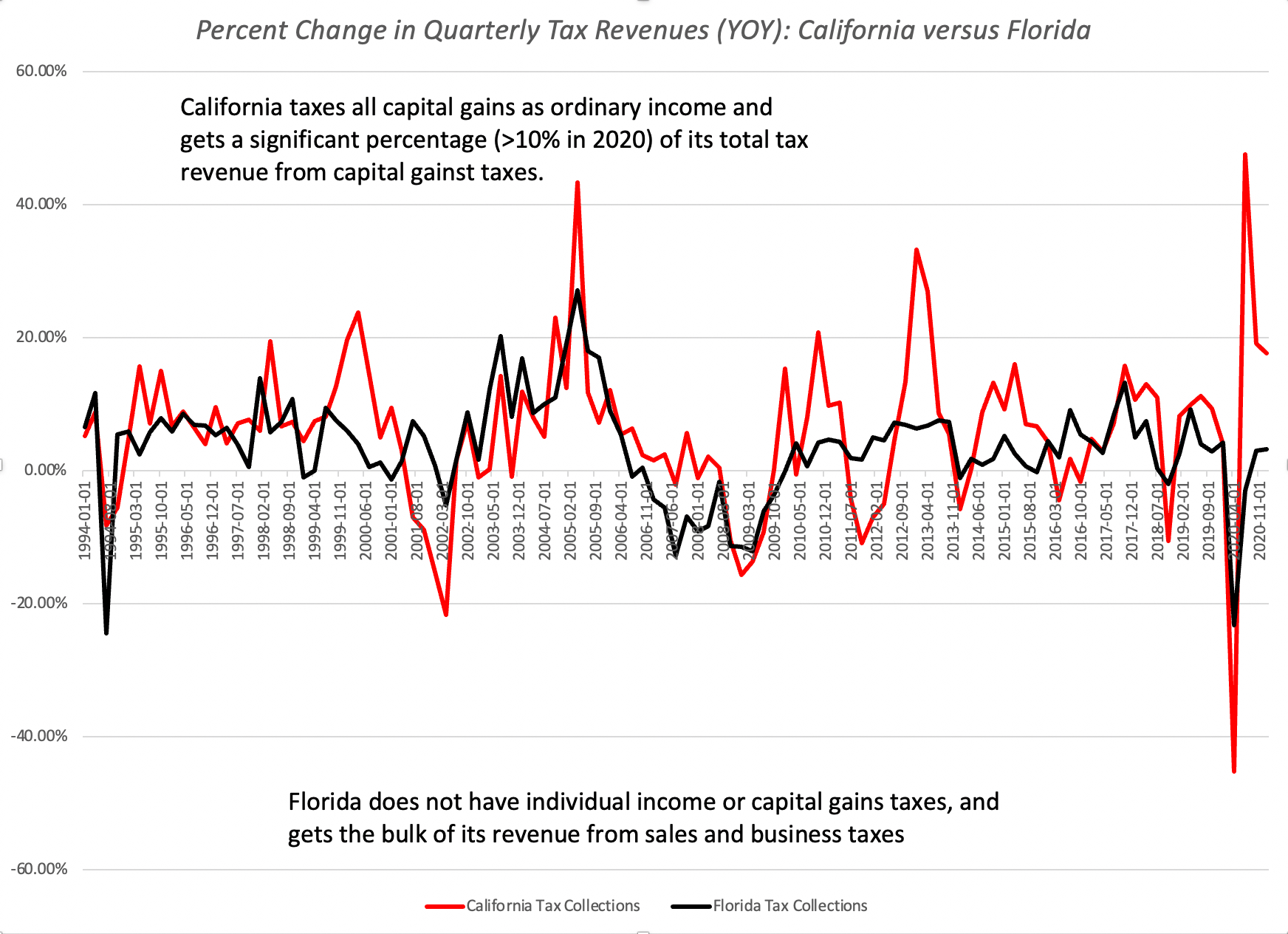

In reality it is a tax on wealth. Unrealized Capital Gains Tax. California does not have a lower rate for capital gains.

Based on httpswwwftbcagov releasing on Feb 18 2020. All capital gains are taxed as ordinary income. Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy.

To report your capital gains and losses use US. It would impose significant. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains.

532 Glossary of Terms. High-income people also pay an. Thus capital gains and losses are reported in the year in which the investment fund buys or sells the.

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. How to report Federal return. HSA earnings taxable in California.

Saturday May 7 2022. California is generally considered to be a high-tax state and the numbers bear that out. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form.

The Tax Benefits Of Direct Indexing Not A One Size Fits All Formula The Journal Of Index Investing. Households worth more than. Unrealized capital gains tax california.

FTTs tax financial trades placing another tax on top of existing taxes on capital gains and corporate income. 30 2021 Published 1040 am. As a tax levy this bill would be effective immediately upon enactment and.

Actually good point. Such a tax is really a tax on wealth. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired.

A Texas resident would see the following. In California HSA accounts are treated as a normal investment account. A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by someone who cannotquoting the pollock decisionshift the burden upon some one.

The Golden State also has a sales tax of 725 the. Taxing unrealized Capital gains on the value. 531 Examining the Built-In Gains Tax Issue.

Tax pyramiding obscures the impact of taxes on taxpayers while. 531 Examining the Built-In Gains Tax Issue. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

In general an S corporation is subject to the built-in gains tax when it. Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out.

Do Offshore Companies Pay Capital Gains Tax Tax Free Citizen

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Strategies Using Nua For Modestly Appreciated Stock

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Aswath Damodaran On Twitter As Increases In Tax Rates Are Taken Off The Table Taxing Billionaires On Unrealized Capital Gains Seems To Be Gaining Traction I Am Amazed By Congress S Capacity To

What Are Unrealized Capital Gains And Losses Bright

Understanding The California Capital Gains Tax

Eliminate Capital Gains Tax With A Trust

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax Calculator 2022 Casaplorer

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)